Table of Contents

- 2024 Form IRS W-9 Fill Online, Printable, Fillable, Blank - pdfFiller

- Fillable Online W9 form 2023 fillable pdf. W9 form 2023 fillable pdf ...

- W9 Form Download 2025 - Hollie Roseline

- Free IRS W-9 Form Template- Download and Edit in 2023 | Irs forms ...

- Digital W9 Form 2025 - Otha Tressa

- Free IRS W-9 Form Template- Download and Edit in 2023 | Irs forms ...

- Form W9 2023 Pdf - Printable Forms Free Online

- Digital W9 Form 2025 - Otha Tressa

- Fillable Online W9 form 2023 fillable pdf. W9 form 2023 fillable pdf ...

- Blank 2020 W9 Form | Calendar Template Printable

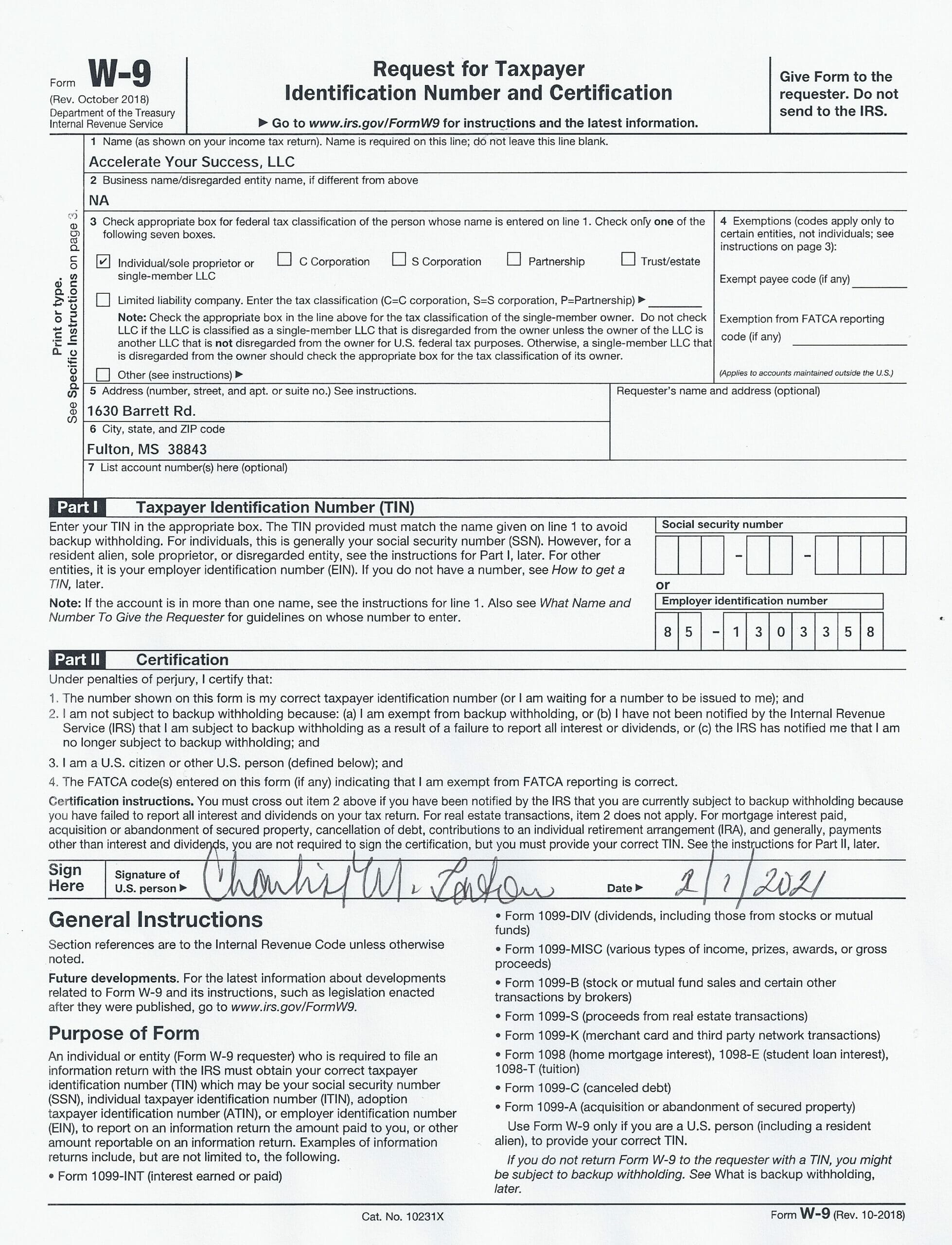

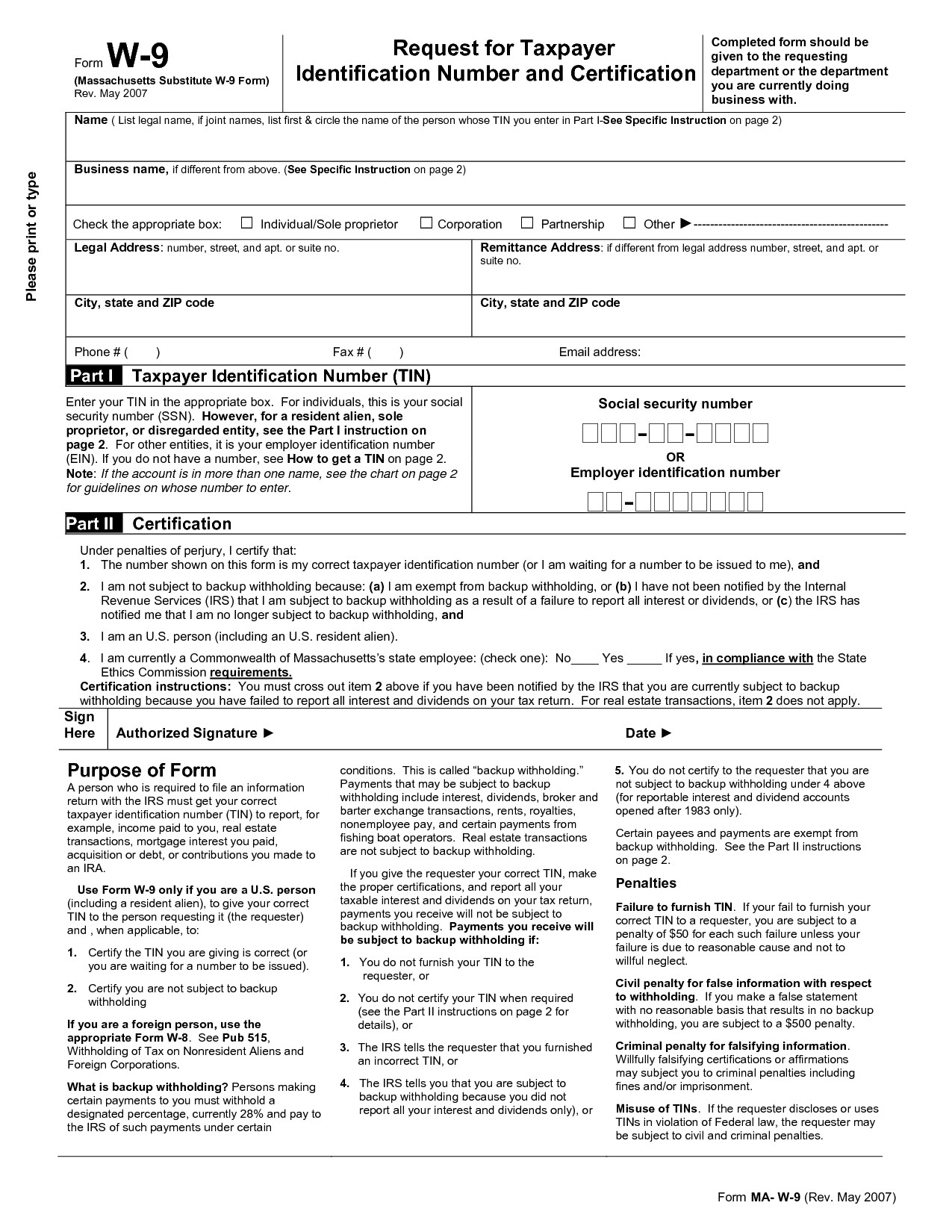

The PDF Form W-9, also known as the Request for Taxpayer Identification Number and Certification, is a standard form used by businesses and other entities to provide their taxpayer identification number (TIN) to other parties, such as banks, financial institutions, and government agencies. The form is typically required for entities that are subject to backup withholding, such as independent contractors, freelancers, and sole proprietors.

Key Changes in the Updated PDF Form W-9 (Rev. March 2024)

Importance of Accurate Completion

To ensure accurate completion, entities should carefully review the form's instructions and provide all required information, including their TIN, business name, and address. It is also essential to certify their tax status and provide any additional required documentation.

In conclusion, the updated PDF Form W-9 (Rev. March 2024) is a critical document for tax compliance in the United States. Entities must ensure accurate completion of the form to avoid potential penalties and backup withholding. By understanding the key components and changes in the updated form, businesses and individuals can ensure compliance with current tax laws and regulations. For more information and to access the new PDF Form W-9 (Rev. March 2024), visit taxdepartment.gwu.edu. By following the guidelines outlined in this article and using the updated PDF Form W-9 (Rev. March 2024), entities can ensure seamless tax compliance and avoid any potential issues.